Solutions

Prevent Check Fraud Faster & Better

AI-powered check fraud detection for banking, fintech, and financial institutions. See how DataVisor’s advanced AI can safeguard your institution from costly check fraud.

Download the Solution Sheet

Check Fraud Prevention Solution You Can Count On

60%

Less Check Fraud

Reduce financial losses and manual review costs with accurate detection.

5x - 20x

More Efficient

Boost review and decision with link analysis, smart investigations, auto decisions and bulk actions.

8 Weeks

Fast Integration

Provide rapid and flexible integration with your systems and support real time and batch processing

You have

Challenges

We have

Solutions

1

High Volume

of fraudulent check transactions

Prevent fraud, Protect revenue

AI-powered, real-time fraud detection that identifies counterfeit, washed, and altered checks before they are processed.

2

False positives

Leading to legitimate transaction declines

Fewer disruptions, Happier customers

DataVisor’s dynamic Rules Engine, combined with AI Co-Pilot, reduces false positives by 50%.

3

Emerging tactics

New unknown fraud patterns

Detect new threats, Stay secure

Patented unsupervised machine learning identifies new fraud patterns, including sophisticated and coordinated attacks.

4

Multiple systems

Fragmented customer data

One view, Smarter decisions

Comprehensive customer profiles integrate data from multiple sources, including check and transaction history, to provide a 360-degree view of each customer.

5

Manual reviews

Causing increased operational cost

Save time, Cut costs

Auto-decisioning capabilities and bulk actions streamline manual reviews, reducing investigation time and improving efficiency by 5x.

Want to see for yourself?

Request Demo

"Our engagements with them have proven what a great partner they are. I’m a big advocate with my credit union peers talking about DataVisor, they’ve really earned our business."

Doug Nahas

COO, NASA Federal Credit Union

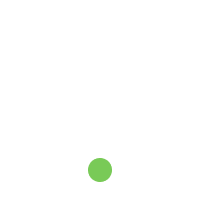

Enhanced Detection with Mitek’s Advanced Image Analysis

DataVisor’s AI-powered fraud detection platform includes built-in integration with Mitek’s advanced image analysis, enabling checks to be compared against consortium profiles and effectively identifying counterfeit or altered checks using over 18 attribute scores.

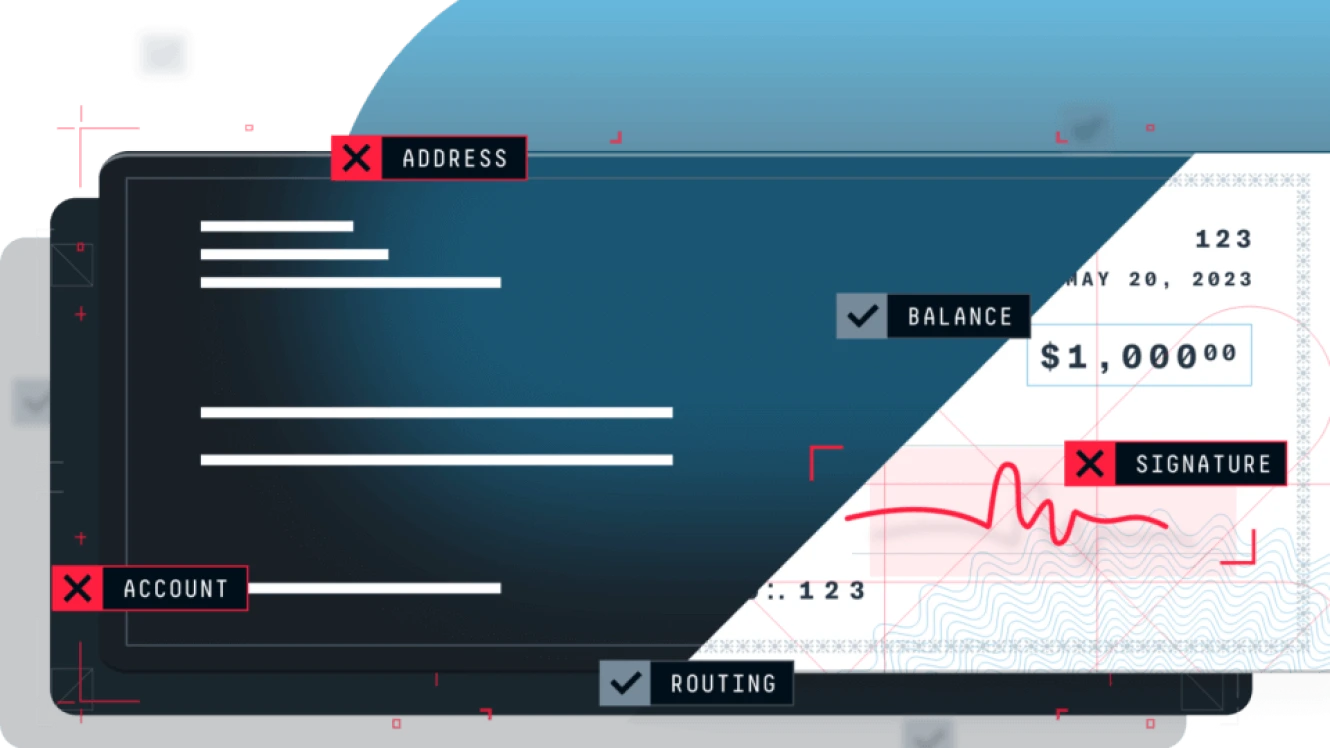

DataVisor’s End-to-End Check Workflow

1. Data Orchestration

Checks are processed in real-time or through batch processing. Checks captured via mobile (Remote Deposit Capture), ATM or deposited at branches can be sent directly to DataVisor’s Real-Time API. Sending a collection of check data in batch go through a separate initial step via our Batch Runner.

2. Detection Engine

Our Detection Engine allows financial institutions to configure their strategy using a combination of rules, ML models, and additional risk signal callouts. The engine automatically evaluates each event, providing automatic decisions to accept, decline, or review.

3. Risk Signals & Customer Communication

Mitek Integration: Utilizes advanced image analysis technology to analyze checks, providing over 18 distinct attribute scores essential for assessing the authenticity and risk level of each check.

Twilio SMS Verification: Engages customers directly through SMS to verify high-risk transactions, enhancing security and customer interaction.

4. Case Management

Our Case Management equips customers with a comprehensive platform to manage workflows, queues, and decision processes.

It features DataVisor’s Knowledge Graph, a sophisticated link analysis tool that enhances investigative efficiency by visualizing data connections. Additionally, the system allows direct viewing and reviewing of check images, aiding swift case resolution

Comprehensive Protection Against

All Types of Check Fraud

No matter the method, DataVisor’s AI-powered platform is equipped to handle every type of check fraud. Our advanced machine learning models detect and prevent a wide range of check fraud schemes, including:

Check Kiting

Check Washing

Remote Deposit Capture (RDC) Fraud

Counterfeit Check

Paperhanging

Complete Protection for Your Organization & Customers

Account Onboarding

Quickly verify new customers while blocking synthetic IDs, stolen identities, and fraudulent sign-ups.

Application Fraud

Balance risk in account onboardings and loan applications.

ATO Prevention

Protect customer accounts from takeover attempts

Card Fraud

Block bad payments and reduce false declines

ACH and Wire Fraud

Combat financial crime in electronic fund transfers

AML Compliance

Manage BSA/AML programs and limit risk exposure

Ready to Take Control of Check Fraud?

Our experts are here to help. Talk with a check fraud expert about your fraud needs and how you can stop evolving fraud threats.

Oops! Something went wrong while submitting the form.

Talk to us

"As fraud and AML become more sophisticated, it’s critical to work with partners who are forward-looking and continuously innovating."

David Pedraza

Director of AML Surveillance at Guardian Life

.svg)