ACH, RTP®, Wire, and SWIFT Fraud

Combat financial crime in electronic fund transfers with precision and agility. Control risk, deploy real-time payment channels quickly, and exceed your customers’ expectations with DataVisor.

Solution Overview

Gain a Holistic View of Transaction Data

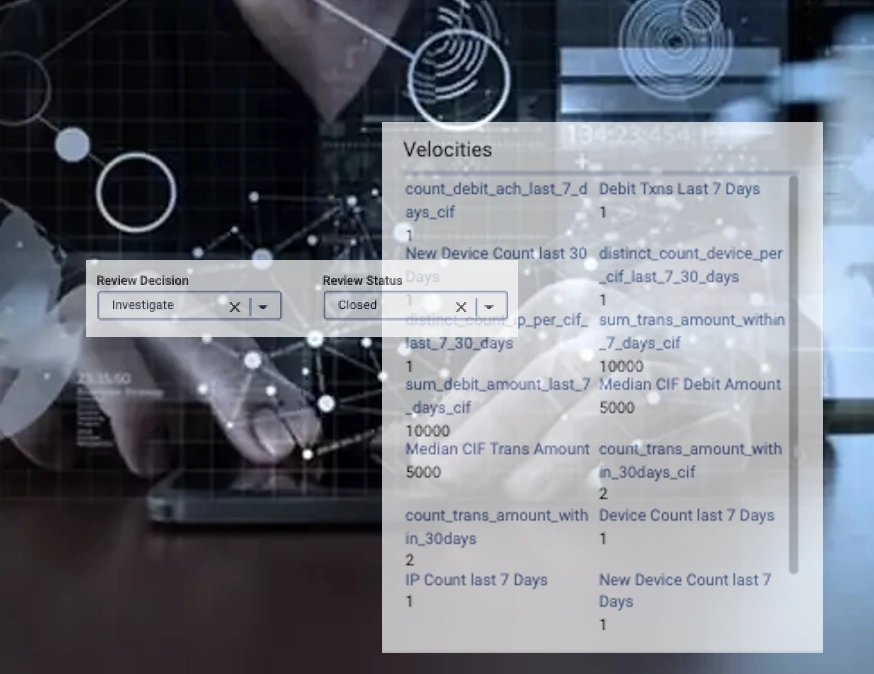

Build better transaction fraud strategies with hundreds of proven and ready-to-use data attributes (features) specific to ACH, RTP®, Wires, and SWIFT fraud. Identify transaction-related activities initiated by compromised mobile devices to defeat bot traffic with dEdge, a cutting-edge SDK that delivers device and behavior intelligence.

Enrich in-house data sources with a complete catalog of third-party signal providers for electronic fund transfer fraud management, including Ekata, Q6, and Equifax.

Monitor Transactions with Precision and Efficiency

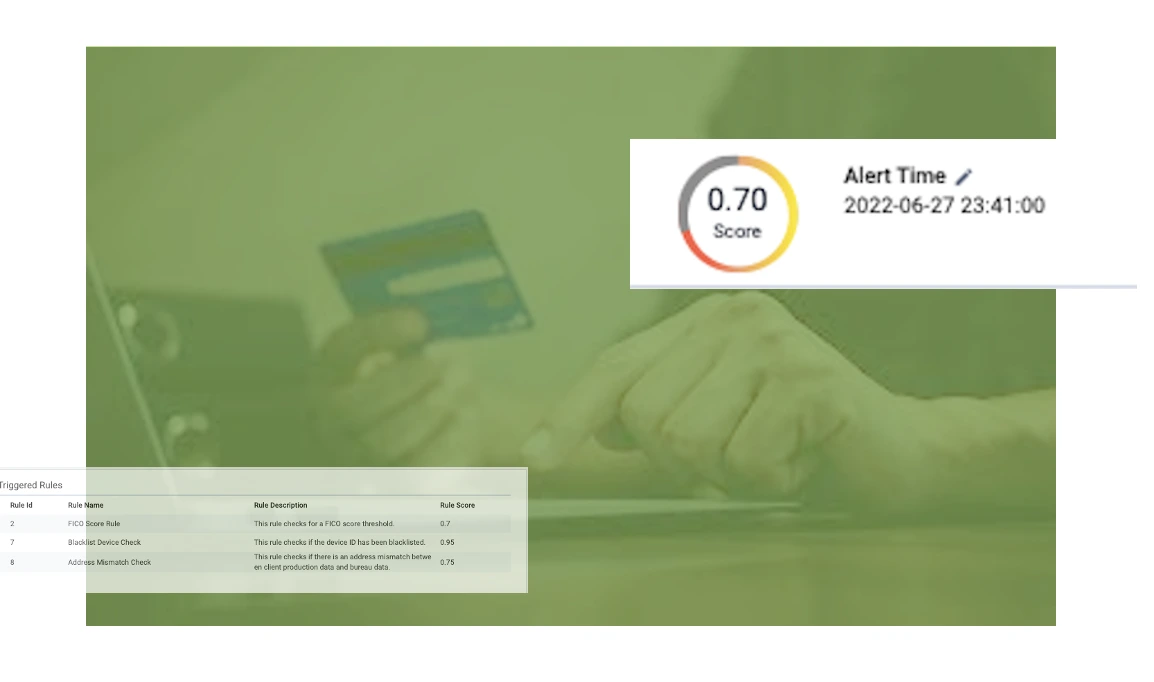

Realize the power of automation to reduce operating expenses and focus investigations on suspicious transactions that merit them. Boost review efficiency with Case Management, the digital fraud investigations tool that organizations control and can fully customize to unlock the next level of risk management. Build, visualize, and implement payment fraud decisioning strategies in Decision Flow, a flexible interface that manages rulesets and transaction verification workflows with unparalleled efficiency.

Increase Automation and Gain Operational Efficiency

Realize the power of automation to reduce operating expenses and focus investigations on suspicious transactions that merit them. Boost review efficiency with Case Management, the digital fraud investigations tool that organizations control and can fully customize to unlock the next level of risk management. Build, visualize, and implement payment fraud decisioning strategies in Decision Flow, a flexible interface that manages rulesets and transaction verification workflows with unparalleled efficiency.

Sara Frankhauser

|Chief Executive Offer

Explore Other Fraud Solutions

Don't let first-party, third-party, and synthetic identity fraud hinder growth. Use holistic data analysis and digital fingerprint tracking to surface coordinated groups of fake applicants, suspicious behaviors, and cross-account links with a solution that's easy to use and scales with your business.

Application Fraud

Prevent fake and synthetic onboardings and identify high-risk applicants in card, loan, and BNPL products.

Card Fraud

Make better decisions in real time and block bad payments and first-party fraud without adding friction for good customers.

AML Compliance

Adapt to new money-laundering tactics, reveal unknown financial crimes, and maintain compliance and transparency.